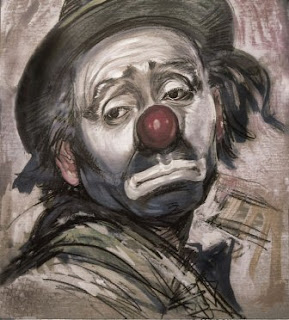

Kent u de figuur in het plaatje van vandaag?

Nee?

Dachtikwel.

Ik leg uit:

Ooit was hij iemand die zich voordeed als monetair econoom (een binnenkort uit Van Dale's Woordenboek der Nederlandse Taal te verwijderen begrip, dat in het grootste deel der 20ste eeuw betekenis had, maar inmiddels al zo'n 36 jaar een historisch artefact is, waaraan echt niemand waarde hecht).

Nou dan weetuhetwel, iemand die niet bijtijds geloefd, gereefd, overstag is gegaan etcetera...

Tegenwoordig slijt hij zijn leven als miskend genie (zijn woorden), is hij directeur van een stichting die onder zijn beheer werd leeggeroofd (was dus als bestuurder nogal incapabel, maar werd uiteraard gesteund in zijn 'gedoe' door een College van Bestuurders dat net als Robin Linschoten en nog zo wat marktsukkels geen idee had waarover te moeten beslissen en 'het' dus maar overliet aan Plaatje's mening), wordt hij eens per honderd interviews weleens door RTL uitgenodigd om zijn zegje te doen (als alle andere coryfeeën b.b.h.h...), heeft hij bijgedragen aan de afbraak van wetenschappelijk onderwijs door af te dwingen dat cursussen van ca 8 weken voldoende diepgang bieden en de argeloze student verder (weg) brengen tot/van zijn ideaal, te weten: hoe wordt ik snel een bonusvanger, zonder daarvoor intellect te hebben meegebracht voor mijn nietsvermoedende baas. Want wetenschap gaat immers om ON-DER-ZOEK en dan mag het on-der-wijs wel een vachtje veren laten....

Zo iemand dus, maar dan erger.

Kort geleden werden de Nobelprijzen Economie (nooit door Alfred Nobel ingesteld, maar gefinancierd door een bank toch werkelijkheid geworden...) toegekend aan twee mensen (M/V) die tijdens hun carriëre getracht hebben IETS in te brengen naast het door de figuur in het plaatje voorgesteld, als alomoverheersend, overvloedig rationeel duidelijk, maar tegenwoordig amechtig naar adem happend, economisch systeem: het marktdenken, inclusief de daarbij behorende zegeningen. Alle gekheid op een teakhouten balk:

NIEMAND in het 'Nederlandse' heeft de moed genomen om iets ten faveure van Ostrom/Williamson (V/M) te zeggen, waar zij in vorige jaren maar al te graag werden geinterviewd en geciteerd om de zegeningen van MarktDenken-Economen te verheerlijken. Bij Ostrom/Williamson kijken ze wel uit, die 'old school' 'DESKUNDIGEN', want:

- a) ze weten niets van de kwaliteiten van die winnaars,

- b) ze hebben hun artikelen immers altijd als onzin in de open haard gedonderd

- b) als ze al iets weten zijn ze het er dus niet mee eens,

- c) want diep, maar ook ondiep, in hun hart geloven ze dat wat deze winnaars zeggen totale flauwekul is (en daarom zijn ze dus ook te typeren als 'old school')

en daarom dienen dit type klungeleconomen dus met wortel en tak te worden uitgeroeid.

Zo ook de plaatjes mens.

RARA wie bedoel ik met mijn welgemeende tirade.... (volgende alinea niet lezen, tenzij je het onderwerp van mijn dagblog bent...)

BTW: als je kijkt en leest, ontslagbeul, ik bedoel jou natuurlijk, maar daar was je zonder deze hint natuurlijk nooit op gekomen. Je bent en blijft immers een nietszeggende sukkel die zijn wetenschappelijke status ontleent aan (inmiddels als zodanig erkende) onzin, maar zal tot je 67ste (jou gun ik het als eerste, maar ik beklaag je publiek dat nog twee-extra-jarenlang zal moeten worstelen met de onzin die je preekt, met de kletspraat die je als 'deskundig' verkoopt op RTL [wat schokt dat trouwens, en zou jij ook niet graag bestuurslid/commissaris van DSB zijn geweest, gezien je illustere (???) voorgangers?]) moeten doorpijgeren, is goed voor je, dan leer je wat werken is, ook al doe je er niet veel voor.

OK, zo kandiewelweerevenjan...

Maar serieus, denken jullie nu echt dat het 'model' dat economenprofessorini dagelijks de wetenschappelijke onderwijswereld inslingeren ook maar ENIG realiteitsgehalte heeft?

Nou dan.